Since the discovery of oil and gas reserves as valuable energy sources, the oil and gas industries have experienced continuous growth and success. Countries rich in oil and gas reserves, particularly in the Gulf region, have witnessed rapid economic development through oil exports.

Today, it is difficult to find a machine or industry that does not rely on oil and gas as fuel. However, this extensive usage has had adverse effects on the environment, leading to pollution and compromised air quality. The pressing trend in the industry outlook is the increasing awareness of climate change and the urgent need for clean energy solutions. Environmentalists are actively advocating for sustainable practices, and industries across the board are striving to adopt cleaner energy sources and recycle waste materials for the benefit of the environment.

Looking ahead, the oil and gas industry will witness a transition towards alternate resource methods for energy generation in developed countries, as they aim to showcase a more renewable energy outlook to the world. However, underdeveloped and developing countries are likely to continue relying on traditional sources such as oil and gas. This presents an uncertain situation for the oil and gas industry. To address this challenge, the industry must prioritize finding ways to contribute positively to the environment and work towards sustainable and eco-friendly practices.

Upcoming Trends

In order to gain insights into the future of the oil and gas industry in 2025, it is important to consider the emerging trends that are expected to flourish in 2023. These trends can provide valuable information regarding the industry’s outlook.

The oil and gas industry is expected to experience several significant trends in 2023, which can provide insights into the industry outlook for 2025. Let’s take a closer look at these trends:

- Strong Balance Sheets and Cash Flow Generation:

The industry outlook predicts that the global upstream industry will generate record-high free cash flows, reaching $1.4 trillion by the end of 2023. This projection assumes a stable oil price of $106 per barrel and reflects the industry’s focus on capital discipline, cash flow generation, and shareholder payments. However, it remains to be seen whether companies will prioritize shareholder payments or increase their reinvestment in hydrocarbon projects to meet the growing demand for affordable energy. - Sustainable Energy Transition:

The oil and gas industry has been increasing its investment in clean energy due to supportive legislation and improved cash flows. While this trend is expected to continue, external factors may influence the rate of investment or divert focus away from clean energy. The industry is navigating the transition towards sustainable energy sources, and companies are likely to keep adapting their strategies accordingly. - Policy Influences:

In 2023, natural gas investments are projected to rise, particularly those aimed at reducing greenhouse gas emissions associated with natural gas production and infrastructure. The United States is increasing natural gas production to lower carbon and methane emissions while also meeting the demand for exports, particularly in Europe. Carbon-neutral liquefied natural gas (LNG) and verified gas and oil are expected to gain momentum as well, aligning with global efforts to reduce emissions. - Refining Operations Adaptation:

Refineries may face challenges in response to fluctuating energy demand, concerns about economic contraction, and a significant increase in worldwide refining capacity, estimated to be 1.6 million barrels per day. U.S.-based refiners may prioritize maintaining their existing refining capacity rather than expanding it due to various factors affecting the industry outlook.

While these trends offer valuable insights into the industry, it’s important to note that predicting the future with certainty is challenging. However, analyzing these trends can help shape a more comprehensive outlook for the oil and gas industry in 2025, considering potential shifts, challenges, and opportunities that may arise.

Region wise Outlook on Oil and Gas Industry

Central America:

In 2020, Central America had several operational pipelines, with Guatemala possessing the most extensive crude oil pipeline network, and El Salvador having the longest natural gas pipeline network. Currently, the Acajutla project is the only natural gas pipeline under construction in the region. The construction projects in Central America are expected to contribute to the region’s economic growth, according to the renewable energy outlook report.

Europe:

Europe had over 700 operational pipelines in 2020. Romania had the longest crude oil pipeline network, France had a significant petroleum product pipeline network, Germany had a notable natural gas pipeline network, and the United Kingdom had an extensive NGL pipeline network. Notable pipelines include the Romania pipeline for crude oil, the Trapil ODC pipeline for petroleum products, the Romanian Gas Transmission pipeline for natural gas, and the Romania NGL pipeline for NGL. The European region continues to maintain a strong pipeline infrastructure.

Former Soviet Union:

In the former Soviet Union, Russia had the most extensive network of pipelines for transporting crude oil, petroleum products, natural gas, and NGL. Notable pipelines include the Transneft Oil System for crude oil, the Transneft Product System for petroleum products, the Russian Gas System for natural gas, and the cpipeline for NGL. The region relies heavily on its pipeline infrastructure to transport hydrocarbon resources.

Middle East:

The Middle East had over 400 operational pipelines in 2020. Iran had the longest network of petroleum products and natural gas pipelines, while Saudi Arabia had the most significant network for transporting crude oil and natural gas liquids (NGL). Notable pipelines include the Ahwaz-Rey crude oil pipeline, the Kermanshah-Tabriz petroleum products pipeline, the Oman Gas System for natural gas, and the Abqaiq-Yanbu NGL pipeline. The Middle East region plays a crucial role in the global oil and gas industry.

North America:

North America had over 1,600 operational pipelines in 2020, with the United States having the most extensive network for transporting crude oil, petroleum products, natural gas, and NGL. Notable pipelines include the Lakehead System for crude oil, the Magellan System for petroleum products, the NGTL System for natural gas, and the Mid-America System for NGL. The pipeline infrastructure in North America is vital for domestic energy transportation.

Oceania:

In Oceania, Australia had the most extensive network of pipelines for transporting crude oil, petroleum products, natural gas, and NGL. Notable pipelines include the Jackson-Moonie crude oil pipeline, the Sydney-Newcastle petroleum products pipeline, the New Zealand natural gas pipeline, and the Moomba-Botany NGL pipeline. The pipeline infrastructure in Oceania supports the region’s energy transportation needs.

South America:

South America had over 400 operational pipelines in 2020, with Colombia having the longest crude oil pipeline network and Brazil having the longest petroleum product pipeline network. Argentina had the most extensive network for transporting natural gas and NGL. Notable pipelines include the Southern Oil System for crude oil, the Campo Duran-Montecristo pipeline for petroleum products, the Transportadora de Gas del Sur S.A. pipeline for natural gas, and the Poliducto MEGA pipeline for NGL. The renewable energy outlook predicts continued growth in the transportation of petroleum products in South America.

These regional insights provide an overview of the oil and gas industry’s infrastructure and outlook in different parts of the world, highlighting the significance of pipeline networks for transporting various hydrocarbon resources.

Conclusion

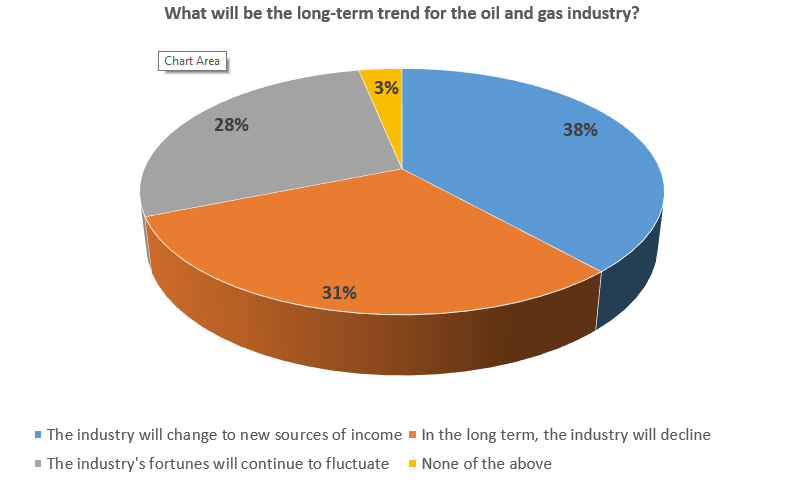

Based on the predictions made by market analysts regarding the energy sector outlook for 2025, it appears likely that the oil and gas industry will continue to thrive in the future. As technological advancements progress, the demand for fuel is expected to rise accordingly. However, it is crucial to consider the environmental implications of oil and gas exploration.

In recent times, there has been growing concern about climate change and its impact on the planet. As a result, there is a greater emphasis on conducting oil and gas operations in an environmentally friendly manner. It is essential for the industry to adopt sustainable practices, minimize emissions, and invest in renewable energy sources.

While the data and projections suggest a positive outlook for the oil and gas industry, it is important to recognize that the industry’s future can be significantly influenced by environmental factors and the industry’s commitment to mitigating its impact on the planet. By prioritizing environmental responsibility and adopting eco-friendly practices, the oil and gas industry can maintain its growth trajectory while also contributing to a sustainable and greener energy future.